howard mcsweeney1- Location: Dover

- Registered: 12 Mar 2008

- Posts: 62,352

The biggest issue is about N.I. contibutions from the self employed and all sides seem to be against it although in reality it isn't really that drastic.

http://www.bbc.co.uk/news/business-39217655howard mcsweeney1- Location: Dover

- Registered: 12 Mar 2008

- Posts: 62,352

Captain Haddock

- Location: Marlinspike Hall

- Registered: 8 Oct 2012

- Posts: 8,072

howard mcsweeney1 wrote:The biggest issue is about N.I. contibutions from the self employed and all sides seem to be against it although in reality it isn't really that drastic.

The

ONLY new 'issue' announced yesterday would seem to be the NICs and

MOST impartial commentators realise it was removing an unfair discrepancy.

http://www.moneyobserver.com/news/08-03-2017/budget-2017-self-employed-targeted-nic-increases

Meanwhile average weekly earnings

UP and unemployment

DOWN

http://www.tradingeconomics.com/united-kingdom/unemployment-rate

The only problem would appear to be reduced profits for funeral directors since we're not dying fast enough!

https://www.theguardian.com/business/2017/mar/08/uk-deaths-funeral-provider-dignity-2017

What's not to like?

"We are living in very strange times, and they are likely to get a lot stranger before we bottom out"

Dr. Hunter S Thompson

howard mcsweeney1- Location: Dover

- Registered: 12 Mar 2008

- Posts: 62,352

This N.I. hike is unlikely to have any effect on self respecting tradespersons who will continue to do the decent thing and work "cash only" then forget to enter same on tax returns.

Paul M likes this

Brian Dixon

- Location: Dover

- Registered: 23 Sep 2008

- Posts: 23,940

it wasn't a budget,but more like a fudget.

Guest 1862 likes this

Guest 1881- Registered: 16 Oct 2016

- Posts: 1,071

Did you forget to put: FACT, afterwards?

The NIC increase for the self-employed reveals why unemployment is actually "down", many of the previously unemployed are not in work but are on a collection/combination of zero hours style jobs (such as couriers). If the unemployment rate fall actually meant people were in bona-fide work then spreadsheet Phil wouldn't look to 'tax' the self-employed.

howard mcsweeney1 likes this

Just because you don't take an interest in politics doesn't mean that politics won't take an interest in you. PERICLES.

Captain Haddock

- Location: Marlinspike Hall

- Registered: 8 Oct 2012

- Posts: 8,072

To quote today's FT:-

The second myth is that tax and employment law changes are somehow necessitated by the recent rise of the so-called gig economy. Yet the structural problems have been with us for many years. New forms of work, like their older counterparts, mean real entrepreneurship and independence for some, and exploitation for others. This is nothing new. London dock workers in centuries past faced the same problem as the zero-hours and agency workers of today: a shift of business risk from the enterprise to individuals, through contracts stipulating self-employment, a lack of guaranteed hours and demands for individual incorporation. Thinking of gig economy-specific regulation misses the point: the underlying issue is an inequality of bargaining power in labour markets with a surplus of individuals seeking work — at any cost.

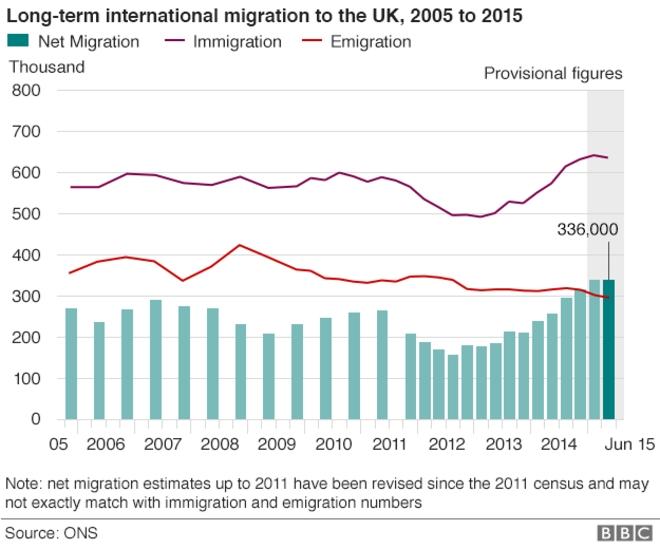

As long as we have an extra 300,000+ flooding the labour market each year what do you expect?

I honestly wish politics and economics were as simple as you seem to think they are. If they were we would already be living in Shangri-La on Thames.

Reginald Barrington likes this

"We are living in very strange times, and they are likely to get a lot stranger before we bottom out"

Dr. Hunter S Thompson

Brian Dixon

- Location: Dover

- Registered: 23 Sep 2008

- Posts: 23,940

where are these extra 300,000 thousand people coming from bob,is it due to a baby boom 16 years ago,or they coming from some where else.

ps,, where do you get these ridiculas figures from.

Captain Haddock

- Location: Marlinspike Hall

- Registered: 8 Oct 2012

- Posts: 8,072

I too think the figure of over 300,000 is 'ridiculous'. Shame it's true.

Pret a Manger anyone?

http://www.bbc.co.uk/news/business-39216136

Next question please.

howard mcsweeney1 likes this

"We are living in very strange times, and they are likely to get a lot stranger before we bottom out"

Dr. Hunter S Thompson

Guest 1881- Registered: 16 Oct 2016

- Posts: 1,071

Captain Haddock wrote:To quote today's FT:-

The second myth is that tax and employment law changes are somehow necessitated by the recent rise of the so-called gig economy. Yet the structural problems have been with us for many years. New forms of work, like their older counterparts, mean real entrepreneurship and independence for some, and exploitation for others. This is nothing new. London dock workers in centuries past faced the same problem as the zero-hours and agency workers of today: a shift of business risk from the enterprise to individuals, through contracts stipulating self-employment, a lack of guaranteed hours and demands for individual incorporation. Thinking of gig economy-specific regulation misses the point: the underlying issue is an inequality of bargaining power in labour markets with a surplus of individuals seeking work — at any cost.

As long as we have an extra 300,000+ flooding the labour market each year what do you expect?

I honestly wish politics and economics were as simple as you seem to think they are. If they were we would already be living in Shangri-La on Thames.

Did the first myth rubbish the second myth?

Just because you don't take an interest in politics doesn't mean that politics won't take an interest in you. PERICLES.

Captain Haddock

- Location: Marlinspike Hall

- Registered: 8 Oct 2012

- Posts: 8,072

First is the myth that it is desirable to encourage self-employment indiscriminately through the tax system. The “self-employed” range from the low paid to the higher paid who benefit considerably from current tax incentives. Untargeted, general tax reliefs cannot be calibrated to reflect all these situations.

Reduced national insurance contributions from the self-employed cannot be justified by reference to differences in other state-funded benefits. If the government wishes to encourage entrepreneurship through the tax system, a uniform and stable tax rate across different forms of work, with incentives focused on investment and employing others, seem a better way to go.

No.

"We are living in very strange times, and they are likely to get a lot stranger before we bottom out"

Dr. Hunter S Thompson

Guest 1881- Registered: 16 Oct 2016

- Posts: 1,071

Captain Haddock wrote:First is the myth that it is desirable to encourage self-employment indiscriminately through the tax system. The “self-employed” range from the low paid to the higher paid who benefit considerably from current tax incentives. Untargeted, general tax reliefs cannot be calibrated to reflect all these situations.

Reduced national insurance contributions from the self-employed cannot be justified by reference to differences in other state-funded benefits. If the government wishes to encourage entrepreneurship through the tax system, a uniform and stable tax rate across different forms of work, with incentives focused on investment and employing others, seem a better way to go.

No.

Are you/they conflating Entrepreneurship with Self-Employment? If you are a self-employed one-man-band, who pays your sick-pay?

Some FACTs...

In 2010, the self-employed (sole trader if you prefer) 3.949 million souls.

As of March 2016 4.695 million souls.

That trend is surely a FACTor in the Chancellor's decisions to break a manifesto pledge.

Source: Office of National Statistics

https://www.ons.gov.uk/employmentandlabourmarket/peopleinwork/employmentandemployeetypes/articles/trendsinselfemploymentintheuk/2001to2015Just because you don't take an interest in politics doesn't mean that politics won't take an interest in you. PERICLES.

Guest 1881- Registered: 16 Oct 2016

- Posts: 1,071

Captain Haddock wrote:I honestly wish politics and economics were as simple as you seem to think they are. If they were we would already be living in Shangri-La on Thames.

Politics and economics are straight forward if you are principled. You stick to your principles don't you? I just happen to have different principles to you. In my opinion, anyone or any enterprise that is earning over the tax threshold should be paying their tax here. Those that don't should be held to account. In simplistic terms, that may include loss of office for Panama Paper authority figures, banned from employment on the BBC for those entertainers in tax avoidance schemes (i.e. Gary Barlow, Jimmy Carr et al). For businesses when they earn a profit here, they pay tax on the profits here.

Guest 1862 and Paul M like this

Just because you don't take an interest in politics doesn't mean that politics won't take an interest in you. PERICLES.

Reginald Barrington

- Location: Dover

- Registered: 17 Dec 2014

- Posts: 3,257

Can we have an emoticon for 'guffaw' please?

Arte et Marte

Captain Haddock

- Location: Marlinspike Hall

- Registered: 8 Oct 2012

- Posts: 8,072

Having different principles to the Bishop (who has put me on the slippery slope of cultural relativism) I'm still chuckling after an evening's onslaught by the nation's favourite tax avoider last night!

Perhaps I should have single handedly boycotted him as a matter of principle?

"We are living in very strange times, and they are likely to get a lot stranger before we bottom out"

Dr. Hunter S Thompson

Captain Haddock

- Location: Marlinspike Hall

- Registered: 8 Oct 2012

- Posts: 8,072

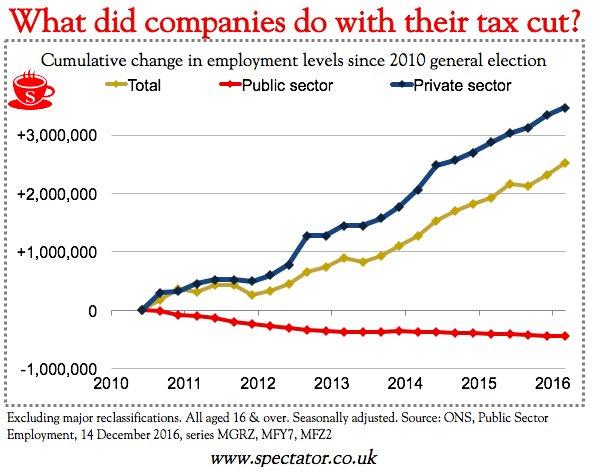

Stone me. Who would have thought it? Corporation tax down results in millions of jobs being created.

"We are living in very strange times, and they are likely to get a lot stranger before we bottom out"

Dr. Hunter S Thompson

Captain Haddock

- Location: Marlinspike Hall

- Registered: 8 Oct 2012

- Posts: 8,072

Excellent news. I've discovered that if I'm a Minister of Religion there's loads of stuff I can claim for against tax. Plus if I designate Marlinspike Hall as a 'Manse' for example I can even screw them for carpets and furniture!

Off to replace robes and items consumed in divine services (such as communion bread and wine) - See Box 25

https://www.gov.uk/government/uploads/system/uploads/attachment_data/file/504980/sa102m-notes-2016.pdf

Little wonder that a friend on the General Synod is looking forward to retiring to the rather nice property he has on the Welsh Borders far from the riff-raff whose souls he has been looking after in East London!

"We are living in very strange times, and they are likely to get a lot stranger before we bottom out"

Dr. Hunter S Thompson

Brian Dixon

- Location: Dover

- Registered: 23 Sep 2008

- Posts: 23,940

he then would have to put up with flocks of wooly girlfriends instead.

Captain Haddock

- Location: Marlinspike Hall

- Registered: 8 Oct 2012

- Posts: 8,072

Dunno about that but I'm sure his time on the Synod will have involved listening to a lot of woolly thinking?

Must go. About to get house registered as place of worship for 'Church of Jesus Christ and Latter Day Tax-Avoiders'.

Paul M, Jan Higgins, Brian Dixon and

1 more like this

Paul M, Jan Higgins, Brian Dixon and howard mcsweeney1 like this

"We are living in very strange times, and they are likely to get a lot stranger before we bottom out"

Dr. Hunter S Thompson

Button

- Location: Dover

- Registered: 22 Jul 2016

- Posts: 3,053

It would appear that things have changed since the days of Caesar Augustus...

(Not my real name.)

howard mcsweeney1 likes this"We are living in very strange times, and they are likely to get a lot stranger before we bottom out"

howard mcsweeney1 likes this"We are living in very strange times, and they are likely to get a lot stranger before we bottom out" Just because you don't take an interest in politics doesn't mean that politics won't take an interest in you. PERICLES.

Just because you don't take an interest in politics doesn't mean that politics won't take an interest in you. PERICLES. "We are living in very strange times, and they are likely to get a lot stranger before we bottom out"

"We are living in very strange times, and they are likely to get a lot stranger before we bottom out"

Paul M, Jan Higgins, Brian Dixon and 1 more like thisPaul M, Jan Higgins, Brian Dixon and howard mcsweeney1 like this"We are living in very strange times, and they are likely to get a lot stranger before we bottom out"

Paul M, Jan Higgins, Brian Dixon and 1 more like thisPaul M, Jan Higgins, Brian Dixon and howard mcsweeney1 like this"We are living in very strange times, and they are likely to get a lot stranger before we bottom out"